Introduction to Precious Metals

Precious metals, notably gold and silver, have held a significant role throughout human history, not only as mediums of exchange but also as symbols of wealth and power. These metals are distinguished by their rarity, intrinsic value, and unique properties, making them desirable for various applications beyond mere investment. Both gold and silver are primarily recognized for their ability to serve as a store of value, which plays a pivotal part in economic systems and individual portfolios.

Historically, gold has been hailed as a universal monetary standard, playing a central role in trade and currency systems across different civilizations. Silver, while also valued, has primarily served more practical purposes due to its widespread application in industries such as manufacturing, electronics, and jewelry. Together, these metals have not only provided financial security to investors but have also been integral to technological advancements and artistic expression.

The prices of gold and silver are influenced by a multitude of market dynamics that include supply and demand equations, geopolitical tensions, and macroeconomic trends. Market sentiment often drives prices, reflecting investor confidence or anxiety during economic fluctuations. For instance, in times of economic uncertainty, investors may flock to gold and silver as safe-haven assets, which can lead to sudden spikes in their prices. Conversely, when the economy shows robust growth and confidence, the demand for these metals may decline, leading to lower prices.

Given their historical significance and their role in the contemporary economy, monitoring the prices of gold and silver becomes essential for investors and consumers alike. Keeping abreast of market trends allows individuals to make informed decisions regarding buying, selling, or holding these valuable assets. Understanding the foundational factors that influence precious metal prices equipped with knowledge rewards both novice and seasoned investors in navigating the complex world of commodities.

Factors Influencing Gold Prices

The price of gold is influenced by a myriad of factors that operate within both the global economy and the market dynamics. One of the most crucial elements is economic indicators, particularly inflation rates. Historically, gold has served as a hedge against inflation, causing its price to rise when inflation rates increase. Investors often flock to gold during times of rising prices, pushing demand and consequently, the market price higher.

Another significant factor impacting gold prices is the strength of the currency, particularly the U.S. dollar. Gold is typically priced in dollars, hence, when the dollar weakens against other currencies, gold becomes cheaper for foreign investors, often leading to increased demand and higher prices. Conversely, a strong dollar can result in decreased demand from overseas, putting downward pressure on gold prices.

Interest rates also play an important role in determining gold prices. When interest rates are low, the opportunity cost of holding gold diminishes as the returns on interest-bearing assets decline. This scenario encourages more investment in gold, elevating its price. Conversely, when interest rates are high, the allure of gold may diminish as investors seek better returns elsewhere, resulting in decreased demand.

Moreover, geopolitical events significantly affect the stability and fluctuations of gold prices. During times of political turmoil, economic uncertainty, or conflict, gold is often viewed as a safe haven for wealth preservation. This instinctive shift towards gold boosts its demand, pushing prices higher. Furthermore, the laws of supply and demand cannot be overlooked; any changes in mining outputs or significant discoveries can alter market dynamics, revealing how the interplay of these various factors shapes the valuation of gold in the market today.

Current Gold Price Trends

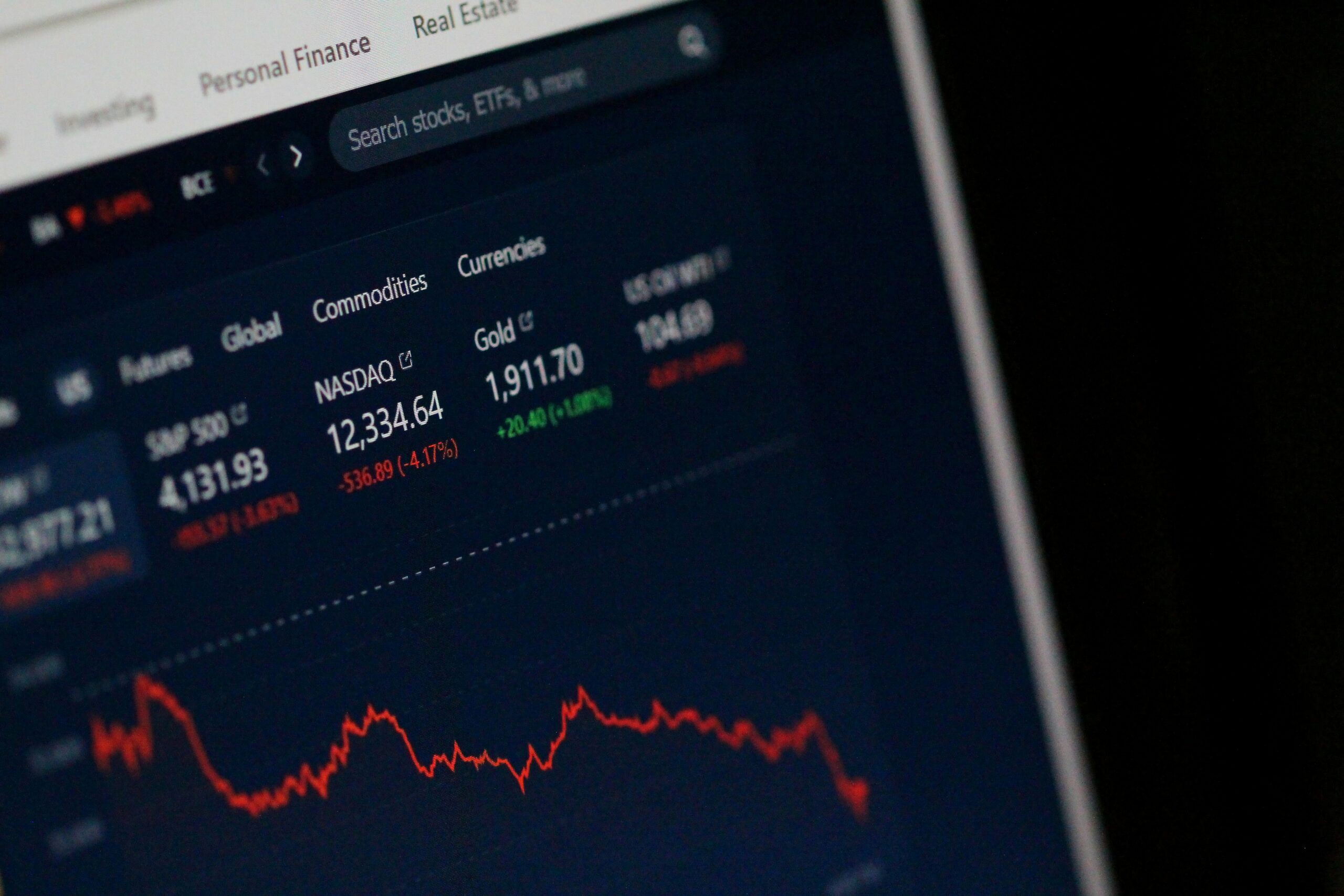

Recent trends in gold prices have reflected a complex interplay of various factors, shaping the perceptions and behaviors of investors. As of October 2023, gold has shown an upward trajectory in its pricing, trading around $1,950 per ounce. This rise can be attributed to several key elements, including global economic uncertainties, inflationary pressures, and geopolitical tensions that lead investors to seek safe-haven assets.

In the past few months, fluctuations in gold prices have been noticeable, particularly in response to economic indicators such as inflation rates and interest rate changes implemented by central banks. For instance, when inflation levels are high, as they have been recently, gold typically sees increased demand as investors look to preserve value. Additionally, any signalling from the Federal Reserve regarding interest rate hikes tends to impact gold prices, as higher interest rates may diminish gold’s appeal in terms of opportunity cost versus interest-bearing assets.

Moreover, geopolitical factors play a crucial role in gold price movements. Events such as conflicts, trade disputes, or significant political shifts often lead to increased volatility in financial markets, prompting a flight to gold. Recently, tensions in various regions have contributed to an uptick in gold purchases. According to analysts, this behavior is rooted in the asset’s historical reputation for stability during times of crisis.

Experts further project that the gold market may continue to experience fluctuations driven by upcoming economic releases and geopolitical developments. Investors are advised to stay informed on these aspects, as their impact on gold prices could reshape market dynamics in the near future. Understanding these trends is vital for making informed decisions in today’s gold marketplace.

Understanding Silver Prices

Silver prices play a crucial role in the global market, often drawing comparisons to the more widely known gold prices. Although both precious metals share certain economic influences, silver embodies unique characteristics that affect its valuation. Primarily, silver’s price is influenced by supply and demand dynamics, industrial usage, and investment trends, all of which differ somewhat from gold.

Silver’s significance extends beyond just its role as a monetary asset; it is widely utilized in various industries, including electronics, solar energy, and healthcare. This industrial demand can create fluctuations in silver prices that gold typically does not experience. As technology advances and the demand for silver in manufacturing rises, it can lead to increased prices and market volatility, making silver an intriguing investment vehicle.

The interplay between gold and silver prices is another essential factor for investors. Often, when gold prices surge, silver prices tend to rise as well, yet not always in proportion. Investors commonly view silver as a more affordable alternative to gold, which can lead to spikes in demand during times of economic uncertainty. This unique relationship also allows for strategic trading between the two metals, as market participants seek to capitalize on price discrepancies.

Moreover, economic indicators such as inflation rates, currency fluctuations, and geopolitical events impact both gold and silver prices, albeit in varying degrees. For instance, during inflationary periods, investors may flock to gold as a safe-haven asset, indirectly influencing silver prices. Conversely, in times of economic stability, industrial demand may drive silver prices higher. Understanding these nuances is vital for investors looking to navigate the precious metals market.

Current Silver Price Trends

The silver market has recently experienced notable fluctuations, reflecting a combination of economic indicators, global events, and investor sentiment. As of October 2023, the price of silver has maintained a relatively stable trajectory, with slight variations reported over the past few weeks. Currently, the silver price hovers around $25 per ounce, which represents a moderate increase compared to earlier in the year when silver was valued below $24 per ounce. This increase can be attributed to several factors, including heightened demand in both industrial applications and jewelry manufacturing, as well as shifts in investment patterns.

One of the primary drivers behind recent changes in silver prices has been the increasing interest in renewable technologies, in which silver plays a crucial role. The adoption of solar panel technology, which utilizes silver in its production, has surged. Additionally, renewed interest in silver as a safe-haven asset amid economic uncertainties has led to a rise in investor purchases. The current market situation is also affected by geopolitical tensions, which typically drive investors towards precious metals as a means of protection against inflation and currency devaluation.

When comparing silver trends to those of gold, it is evident that both metals exhibit a correlation, yet they react differently to market dynamics. While gold is often seen as the ultimate safe-haven asset, silver has a more volatile nature tied to industrial demand. For instance, during economic downturns, gold prices tend to rise predictably as investors seek stability, whereas silver’s performance can be more inconsistent due to its industrial dependencies. Overall, understanding the nuances of current silver price trends is essential for investors looking to navigate this sector effectively.

Investment Strategies in Gold and Silver

Investing in gold and silver has been a method for preserving wealth and diversifying portfolios for centuries. As precious metals continue to gain attention in the financial markets, understanding the various investment strategies is crucial for potential investors. This section examines three primary approaches: physical ownership, Exchange-Traded Funds (ETFs), and mining stocks.

Physical ownership involves purchasing tangible gold or silver in the form of coins, bars, or bullion. This strategy offers investors a sense of security, as it allows complete control over the assets. However, it comes with challenges, such as storage and insurance costs, as well as liquidity issues if fast access to cash is needed. Physical assets can also be subject to market fluctuations, impacting their resale value.

Another popular option is investing in gold and silver ETFs. These funds track the price of the metals and provide investors with exposure to gold and silver without the need for physical storage. ETFs offer enhanced liquidity, as they can be traded on major exchanges like stocks. However, investors should be aware of potential management fees, and the return might not always perfectly mirror the price of the metals due to market dynamics.

Mining stocks present a different approach by investing in companies that extract gold and silver. This method can yield significant returns, particularly during bullish market conditions. Investors in mining stocks often benefit from additional leverage, as the stock prices can rise faster than the underlying metal prices. However, mining companies face operational risks, regulatory challenges, and market fluctuations that can impact their profitability, making this strategy inherently riskier.

In sum, diversifying with gold and silver can be achieved through these strategies, each with its advantages and disadvantages. Careful consideration of individual investment goals and risk tolerance will enhance the effectiveness of incorporating these precious metals into a portfolio.

Risks Involved in Precious Metal Investments

Investing in precious metals such as gold and silver can present a range of risks that prospective investors should carefully consider. One of the most significant risks is market volatility. Precious metals are not immune to price fluctuations, and their values can be significantly affected by various factors, including geopolitical tensions, changes in interest rates, and shifts in currency strength. As market supply and demand fluctuate, prices can experience rapid changes, leading to potential losses for investors who may not be prepared for such volatility.

Another critical risk associated with precious metal investments is liquidity issues. Unlike stocks or bonds, which can typically be bought and sold easily, certain forms of gold and silver, such as bullion or coins, may not always be readily liquidated in the market. This situation can become particularly problematic during times of economic uncertainty or crisis when investors simultaneously attempt to sell their assets. Having an appropriate exit strategy is essential for anyone engaged in investing in these metals, as it can impact their ability to respond quickly to market changes.

The impact of economic downturns also poses a considerable risk to precious metal investments. While gold is often perceived as a safe haven during turbulent times, its price can still decline if the economy grows stronger and investors begin to favor riskier assets. Additionally, silver, while popular for its industrial applications, may see demand decrease during a recession, consequently affecting its price. As such, it is crucial for investors to remain vigilant about the economic landscape and its implications for their precious metal assets.

How to Monitor Gold and Silver Prices

Monitoring gold and silver prices is essential for investors aiming to make informed decisions in the fluctuating precious metals market. To effectively track these prices, utilizing various resources and tools is vital. One of the most reputable sources for real-time data is the London Metal Exchange (LME) and the COMEX, where precious metals are actively traded. These platforms provide accurate pricing as well as trends that can influence the market.

Additionally, financial news websites, such as Bloomberg, CNBC, and Reuters, frequently update their precious metals sections with the latest prices and market analysis. These websites not only publish current prices but also detailed reports and predictive insights based on market performance. Furthermore, investing in subscriptions from specialized market analysis firms can also offer deeper insights into price movements and market forecasts.

For mobile monitoring, several applications offer convenient alerts and notifications related to gold and silver prices. Apps like Kitco and Silver Price provide real-time notifications direct to your phone, ensuring that you remain updated with price fluctuations. These applications feature charts and historical data that can further enhance understanding of market trends that may influence pricing.

Another best practice for staying informed is to follow social media accounts that specialize in precious metals. Influencers, analysts, and companies in the gold and silver industry often share timely insights and updates. Joining forums and communities can also offer valuable information and different perspectives on price shifts and investment strategies.

Lastly, keeping an eye on economic indicators such as inflation rates, currency fluctuations, and geopolitical events will offer a broader context to price changes. Understanding how these factors impact the market will empower you to make informed decisions regarding your investments.

Conclusion: The Future of Gold and Silver Prices

As we analyze the dynamics of gold and silver prices, it becomes evident that various factors contribute to the fluctuations observed in these precious metal markets. The interplay between global economic conditions, interest rates, inflation, and geopolitical tensions significantly affects both investments and consumer sentiment regarding gold and silver. Historically, during times of economic uncertainty or inflationary pressures, gold and silver have served as safe-haven assets, providing investors with a hedge against volatility and loss of purchasing power.

Looking ahead, the demand for gold and silver may be influenced by advancements in technology, particularly in renewable energy and electronics, where silver is used extensively. This increased industrial demand, combined with traditional jewelry consumption and investment acquisition, could sustain or potentially heighten silver prices. On the other hand, gold’s allure continues to be rooted in its historical status as a store of value. Factors such as central bank policies, currency fluctuations, and the overall economic climate will continue to play a vital role in shaping the market landscape for gold.

Investors should remain vigilant and informed about the economic indicators that impact the prices of these metals. Both opportunities and challenges exist in the pursuit of investing in gold and silver. For instance, while price corrections may present a buying opportunity, sudden spikes may signal a shift in market sentiment. By comprehensively understanding market trends and potential outcomes, investors can position themselves strategically to navigate the complexities of gold and silver investments.

In conclusion, keeping abreast of the factors that influence gold and silver prices, as well as maintaining a diversified investment portfolio, can help mitigate risks associated with investing in these precious metals. By balancing insights with caution, both novice and seasoned investors can make prudent decisions in this evolving market landscape.