Understanding Gold Prices

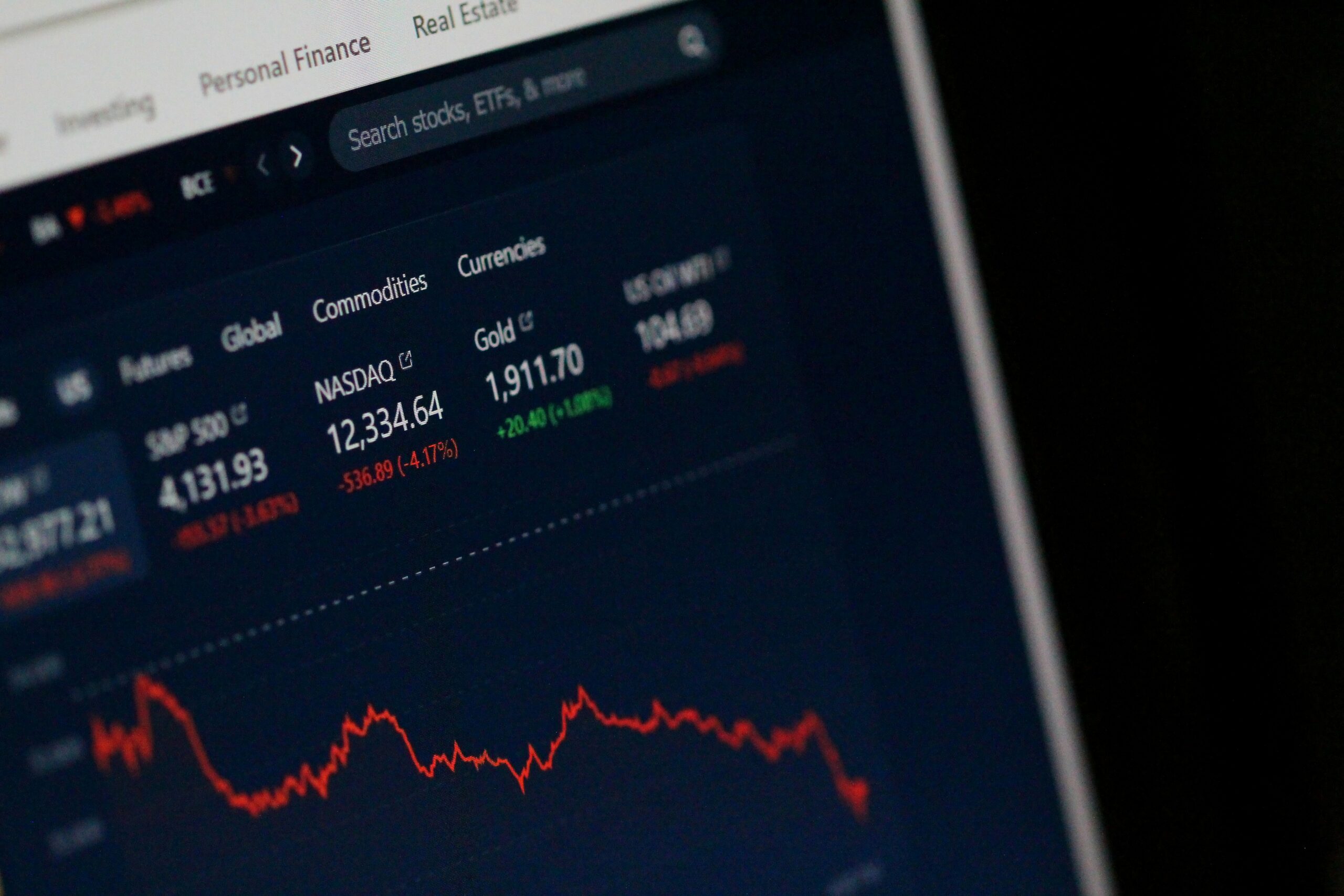

Gold prices are influenced by a myriad of factors that reflect both global and local economic conditions. One primary driver of gold prices is the state of the economy, as gold is often seen as a safe-haven asset during economic instability. When economic indicators, such as GDP growth or unemployment rates, are unfavorable, investors tend to flock to gold, driving up its price.

Currency fluctuations also play a crucial role in the valuation of gold. Since gold is typically traded in U.S. dollars, changes in the value of the dollar can significantly impact gold prices. A weaker dollar makes gold less expensive for holders of other currencies, which can lead to increased demand and, subsequently, higher prices. Conversely, a stronger dollar may suppress demand for gold, resulting in decreased prices.

Inflation rates further contribute to gold price dynamics. When inflation rises, the purchasing power of currency tends to decline, causing investors to seek out gold as a hedge against currency devaluation. Historically, periods of high inflation have correlated with increasing gold prices, as investors view gold as a stable store of value.

Geopolitical events can also create volatility in gold prices. Political instability, military conflicts, or changes in government policies can lead to uncertainty in the markets, prompting a rise in gold investments. The demand for gold tends to surge during times of geopolitical unrest, as investors seek safety and security in tangible assets.

Over the years, gold has maintained its significance as a precious commodity, often perceived as a reliable investment during both prosperous and challenging economic times. Its historical role as a symbol of wealth and a medium of exchange further solidifies its importance in the global market. Understanding these factors is essential for investors interested in navigating the complexities of gold pricing.

Gold Rate in Chennai Today

As of today, the gold rates in Chennai have shown a notable fluctuation, reflecting the ongoing dynamics of both local and global market influences. For 22K gold, the current price stands at approximately ₹5,500 per gram, while the rate for 24K gold is about ₹5,980 per gram. These rates indicate a rise compared to the previous week’s figures, where 22K gold was priced around ₹5,480 per gram and 24K at ₹5,950 per gram, highlighting a trend of increasing demand amidst global economic uncertainties.

The pricing of gold in Chennai is influenced by various factors, including the international gold market, currency fluctuations, and domestic demand, which typically peaks during festive seasons and weddings. Additionally, the import duty imposed on gold and local taxes can also affect the final price. Particularly, investors and buyers in Chennai should be aware that gold refiners and jewelers may add premiums on top of these base rates due to labor, craftsmanship, or brand value.

An analysis of the current trends indicates a general uptick in gold prices driven by geopolitical uncertainties and inflationary pressures globally. Investors in Chennai are increasingly considering gold as a safe-haven asset, prompting a rise in both physical purchases and investment in gold-backed securities. This trend suggests that individuals looking to invest in gold should closely monitor market conditions and be prepared for potential price volatility. Establishing a well-timed investment strategy could provide significant advantages in navigating the complexities of the gold market. Overall, understanding the current gold rates and market trends is crucial for anyone looking to make informed decisions in today’s fluctuating economy.

Silver Rate Today in Chennai

The silver rate in Chennai is subject to daily fluctuations influenced by various factors such as market demand, international prices, and geopolitical events. As of the latest update, the price of 925 silver, which is commonly used in jewelry and other applications, stands at XXXXXX per gram. This value is reflective of the broader trends in the silver market and subject to change throughout the day based on trading activity and investor sentiment.

Several elements play a crucial role in determining the price of silver. Firstly, the global market dynamics heavily influence local rates. When the international price of silver rises, it typically leads to an increase in prices at the local level. The value of the U.S. dollar is another critical factor; a weaker dollar often propels silver prices higher, as commodities become cheaper for holders of other currencies. Additionally, the industrial demand for silver, especially in sectors such as electronics and photography, can also drive prices up.

The correlation between gold and silver prices is noteworthy. Traditionally viewed as safe-haven assets, both metals often experience similar price movements during times of economic uncertainty. However, disparities can arise. For instance, during periods of significant inflation, silver might outperform gold due to its lower price and greater industrial utility. Conversely, in a bullish market, gold could retain higher value while silver lags slightly behind.

Market trends suggest that investors are increasingly turning towards silver as a hedge against inflation. This shift in interest has implications for local prices in Chennai, making understanding the current silver rate not just about the numbers, but an insight into broader economic narratives. By staying informed about these developments, consumers and investors can make educated decisions related to silver investments.

Comparative Analysis: Gold vs. Silver Prices

The current market landscape in Chennai reveals a compelling comparison between gold and silver prices, showcasing their distinct dynamics. Historically, the price ratio of gold to silver has fluctuated significantly, often reflecting broader economic trends and market sentiments. As of October 2023, gold prices are trading at a premium, with fluctuations influenced by global economic indicators and inflationary pressures. In contrast, silver, often considered a secondary investment option, has seen its prices stabilize, allowing for a reevaluation of its investment potential.

Current trends indicate that the price of gold per gram in Chennai is considerably higher than that of silver, which is typically traded in ounces. Investors often regard gold as a safe haven asset during economic uncertainty. This perception contributes to higher demand, thus propelling gold prices upward. Silver, while historically more volatile, is now witnessing growing interest due to industrial applications and its role in the renewable energy sector. Moreover, silver’s historical association with gold results in a ‘Gold-Silver Ratio’ that plays a crucial role in investment strategies.

Understanding the factors influencing supply and demand for both metals is critical for potential investors. For gold, central bank policies and geopolitical tensions tend to impact prices directly. Conversely, silver’s market dynamics are significantly influenced by industrial demand and the broader economic recovery. During periods of economic fluctuations, consumers may pivot toward silver as a more accessible form of investing, subtly leveling the playing field between these two precious metals. As market conditions evolve, monitoring these interrelated factors will provide clearer insights for making informed investment decisions in Chennai’s gold and silver markets.

Investment Strategies in Precious Metals

Investing in precious metals such as gold and silver has become an increasingly popular choice for many investors, particularly for those residing in Chennai. With the inherent volatility in financial markets, these metals often provide a stable investment avenue. Investors face a spectrum of strategies, each tailored to individual risk profiles and financial objectives.

Long-term investment strategies mainly focus on holding gold and silver for an extended duration, capitalizing on their potential for significant appreciation over time. This approach is particularly appealing in a context where economic uncertainty prevails, as precious metals tend to maintain their value. Investors may consider allocating a portion of their portfolio to gold and silver to hedge against inflation and currency fluctuation. Conversely, short-term strategies often involve actively buying and selling based on market trends, which requires a keen understanding of market dynamics and timing.

Diversifying into precious metals can enhance portfolio resilience. Investors in Chennai should consider maintaining a balanced mix of gold and silver, as each metal can perform differently under varied market conditions. Gold is generally seen as a safe haven during times of economic downturn, while silver often sees increased demand in industrial applications, which may influence its price. Before making any investment decisions, it is crucial for investors to assess current market conditions and trend analyses meticulously, as these factors can significantly affect the timing and execution of purchases.

By leveraging informed strategies, individuals can navigate the complexities of investing in precious metals. This approach not only optimizes the potential for returns but also offers a safeguard against varying economic climates, making gold and silver worthy considerations for investment portfolios. Investing wisely in these assets can position investors favorably, enhancing their financial resilience amidst economic fluctuations.

Local Market Insights on Gold and Silver in Chennai

The gold and silver market in Chennai is heavily influenced by various local factors, including demand fluctuations, cultural significance, and the presence of local jewelers. In a city renowned for its deep-rooted traditions, gold holds more than just monetary value; it is intricately woven into the cultural fabric of celebrations, weddings, and festivals. As such, the demand for gold and silver typically surges during significant occasions like Diwali, Pongal, and wedding seasons, leading to noticeable spikes in local pricing.

Local jewelers in Chennai are pivotal players in the gold and silver market. They not only set rates based on prevailing international prices but also consider regional preferences and customer demands. The city is home to numerous well-established jewelry stores, each offering a unique selection of designs that cater to the tastes of its diverse population. Seasonal promotions and offers from local jewelers can significantly affect consumer interest and spending on gold and silver, further impacting the overall market dynamics.

Additionally, Chennai’s purchasing culture plays a crucial role in determining the price fluctuations of gold and silver. People often buy gold during auspicious timings, which are deeply respected in local belief systems. This seasonal buying behavior combined with cultural sentiments creates a peak demand season that can drive prices higher. Conversely, in lean seasons, the market may witness a decline in purchases, potentially stabilizing or lowering prices. Understanding these local market factors is essential for anyone looking to invest in gold and silver in Chennai, as they provide valuable insights into potential price trends and optimum timing for purchases.

Currency Influence on Gold and Silver Rates

The relationship between currency strength and the prices of gold and silver is an essential aspect of understanding the fluctuations in these precious metals in Chennai and beyond. In particular, the Indian Rupee (INR) plays a significant role in determining the market rates for gold and silver. When the value of the INR increases against foreign currencies, it can lead to a decrease in the price of gold and silver within the domestic market. Conversely, if the value of the INR declines, the costs of these precious metals may rise, reflecting higher import expenses and market dynamics.

Investors must pay attention to the exchange rates, as these can significantly affect their purchasing decisions. For example, a stronger rupee typically means that gold and silver imported from abroad become less expensive. As a result, local buyers might find the rates for these metals more affordable and may decide to purchase higher quantities, driving up demand. On the flip side, a weaker rupee often translates to increased costs, leading investors to reconsider their strategy concerning precious metals.

Furthermore, global economic conditions and fluctuations in foreign currency markets heavily influence the INR. Factors such as inflation, changes in interest rates, and geopolitical events can lead to volatility in currency values, which directly impacts the pricing of gold and silver as investors use them as a hedge against currency depreciation. Therefore, local and international investors need to monitor these changing dynamics closely, as the interplay between the INR and global gold and silver rates could significantly impact their investment strategies and profitability.

Future Trends: Gold and Silver Prices Outlook

As we examine the future trends of gold and silver prices in Chennai, it is crucial to consider various economic indicators and market forces that influence these precious metals. Analysts emphasize that fluctuations in global economic stability, inflation rates, and interest rates play a significant role in determining prices. In particular, gold and silver are typically viewed as safe-haven assets during times of economic uncertainty, leading to increased demand and potential price hikes.

Recent projections suggest that gold prices may witness a gradual increase due to ongoing geopolitical tensions and rising inflationary pressures. Experts anticipate an upward trajectory in the coming months, as investors tend to flock towards gold as a protective measure against economic downturns. Moreover, central banks around the world have been increasing their gold reserves, further bolstering demand and pushing prices upward.

On the other hand, silver, often referred to as the “poor man’s gold,” also exhibits strong potential for growth, albeit under different circumstances. Analysts point out that silver prices are closely tied to industrial demand, given its applications in technology and renewable energy sectors. The expected growth in these industries may drive up silver prices as manufacturers seek the metal for production. Additionally, any significant shifts in the supply chain or disruptions in mining activities could further impact silver prices in unforeseen ways.

However, market shocks must not be overlooked. Sudden changes in trade policies, currency fluctuations, or new economic policies can create volatility in the precious metals markets. Investors are advised to remain vigilant and informed about these global trends to make prudent decisions regarding gold and silver investments in Chennai. Expert opinions often indicate cautious optimism; while some foresee an increase in prices, external factors could lead to unexpected downturns. As such, continuous monitoring of market conditions is essential.

Conclusion: Making Informed Decisions in Precious Metal Investments

In the current financial landscape, understanding the fluctuations of gold and silver prices is crucial, especially for potential investors in Chennai. The market dynamics of these precious metals are influenced by various factors including global economic conditions, currency fluctuations, and local demand. Staying updated on daily or weekly price changes allows investors to make more informed decisions regarding their purchases.

As of today, gold and silver prices in Chennai reflect broader market trends and can serve as a guide for potential buyers. Investors are encouraged to monitor these trends closely, considering not only the current prices but also historical data to discern patterns. This will provide insight into when might be the best time to invest. Additionally, understanding the local context—such as festivals or wedding seasons, which typically drive demand—can also inform your purchasing decisions.

Given the volatility of precious metal prices, diversification should be an integral part of an investment strategy. Investing solely in gold or silver may not be prudent; instead, consider a balanced portfolio that can reduce risk while maximizing potential returns. It is advisable to consult with financial advisors or market experts who specialize in precious metal investments to tailor your strategy to your specific financial goals.

Ultimately, being proactive and educated about the current gold and silver prices in Chennai will empower investors to navigate the market confidently. Conducting thorough research and staying attuned to price trends can make a significant difference in investment outcomes. As the market continues to evolve, adapting investment strategies accordingly will be essential for achieving long-term financial objectives.