Introduction to Gold Pricing

Gold pricing is influenced by a myriad of factors that interplay within the global economy and financial markets. One of the primary determinants of gold prices is the fluctuation in demand and supply. When the demand for gold increases, perhaps due to heightened interest from investors seeking to hedge against inflation or economic instability, prices tend to rise. Conversely, when demand diminishes, often because of increased market confidence or a strong equity market, gold prices may decline.

Economic indicators also play a critical role in determining gold prices. For instance, interest rates, inflation rates, and currency strength are pivotal in shaping investor sentiment towards gold. Lower interest rates often correlate with increased gold buying, as the opportunity cost of holding non-yielding assets decreases. Furthermore, inflationary pressures can drive investors toward gold as a safe haven asset, compelling them to purchase in anticipation of preserving their wealth.

International trends, particularly those that arise from major economies, significantly impact gold pricing. Geopolitical tensions, trade policies, and changes in regulations concerning gold mining and trading can sway market dynamics. Additionally, the value of the U.S. dollar is intricately linked to gold prices; a stronger dollar typically leads to lower gold prices and vice versa. Global economic events, such as financial crises or significant debt escalations, may also prompt fluctuations in gold rates.

Understanding today’s gold prices, particularly in major cities across India, necessitates a comprehensive analysis of these multifaceted factors. By considering economic indicators, market demand, and prevailing international trends, stakeholders can gain insights into the price movements of gold in the contemporary market.

Current Dollar Rate and Its Impact on Gold Prices

The dollar rate plays a significant role in determining gold prices, both globally and specifically in India. As a globally recognized standard for value, fluctuations in the dollar can lead to corresponding changes in gold rates. Typically, gold and the dollar exhibit an inverse relationship; when the value of the dollar declines, gold prices tend to rise, and vice versa. This inverse correlation is primarily due to the fact that gold is priced in dollars on international markets.

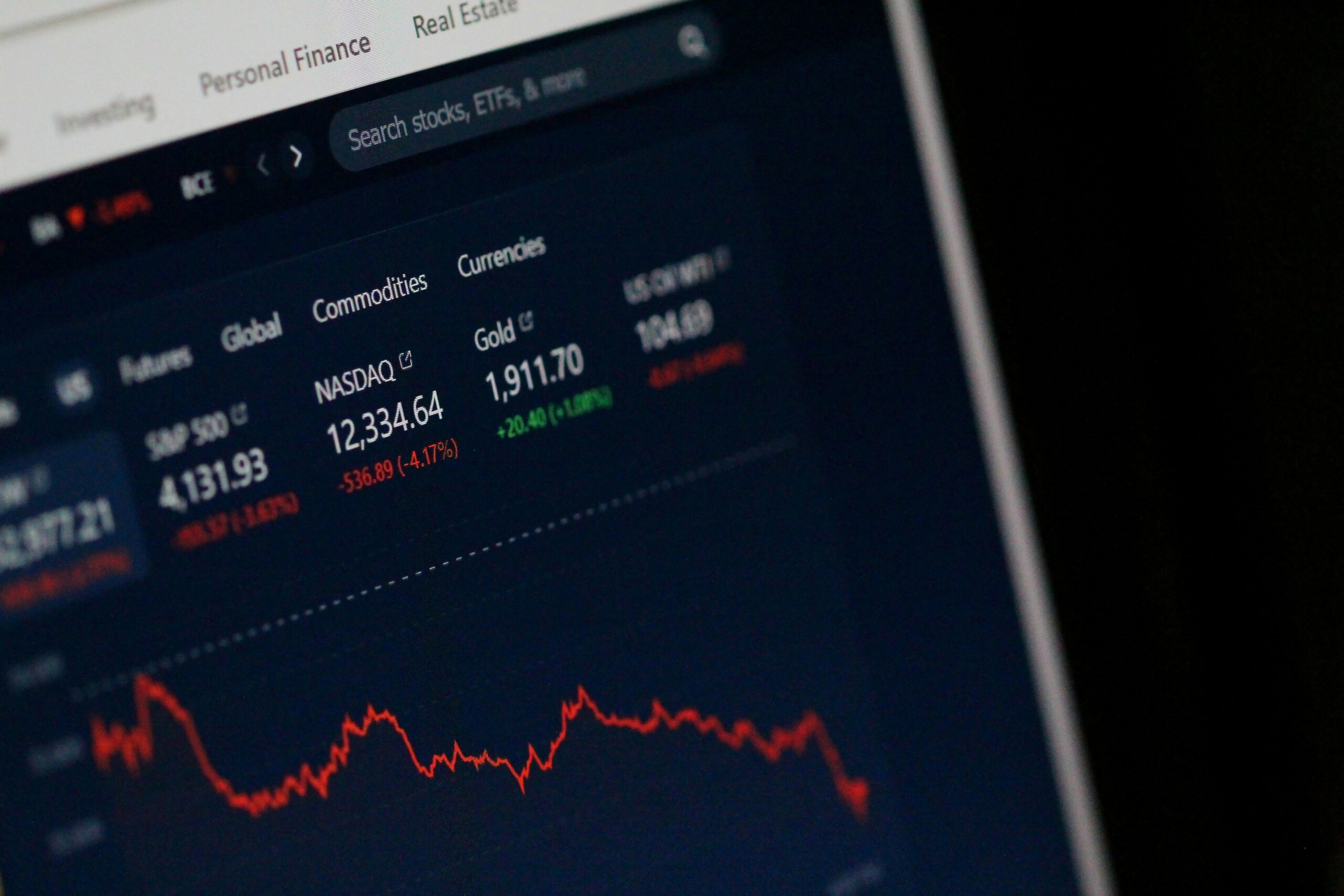

In recent months, the dollar has experienced volatility, influenced by various factors including economic data releases, interest rate adjustments by the Federal Reserve, and geopolitical tensions. A weaker dollar makes gold more affordable for investors holding other currencies, thus driving up demand and raising prices. Conversely, a stronger dollar can have a dampening effect on gold investments. For India, changes in the dollar rate directly impact the local gold market. When the dollar strengthens, Indian consumers may face higher gold prices, complicating buying decisions.

According to market analysts, the current dollar rate is witnessing fluctuations around specific price points which are crucial for investors and businesses engaged in gold trading. As of the latest reports, the dollar rate sits at X amount. This rate indirectly influences the price of gold in Indian markets, currently estimated at Y amount. Investors should remain vigilant about currency trends, as they can provide insights into future gold pricing scenarios. Additionally, geopolitical events and inflation trends further complicate the forecasting of gold prices linked to dollar valuations.

Understanding this dynamic is essential for making informed investment decisions in gold. As such, staying updated on the current dollar rate along with its trends can prove beneficial for both casual buyers and professional investors alike.

Gold Rates Today in Chennai

As of today, gold prices in Chennai reflect a dynamic marketplace, influenced by various economic factors both locally and globally. Currently, the price of 24-karat gold stands at ₹5,640 per gram, while 22-karat gold is priced at approximately ₹5,180 per gram. These rates exhibit fluctuations that can be attributed to multiple elements such as demand and supply dynamics, international gold prices, and currency valuation.

Historically, gold has maintained a significant presence in Chennai’s culture, with the city being one of the major hubs for gold trading in southern India. Over the last decade, there has been a steady increase in gold prices, attributed to increasing consumer demand during festival seasons and weddings, as well as economic uncertainty which drives individuals to invest in gold as a safe haven. For example, in the past year, gold rates in Chennai have experienced an average increase of 10%, a significant shift that has captured the attention of both buyers and investors.

Several factors contribute to the contemporary pricing environment. The global market demand for gold continues to influence local prices. Additionally, the intrinsic value of gold is affected by external economic pressures such as inflation rates and changes in interest rates. The weakening of the Indian rupee against the US dollar also plays a critical role in the cost of gold. Therefore, fluctuations in global gold prices render even slight changes in Chennai’s rates inevitable. In light of these elements, it is paramount for potential buyers and investors to keep a close eye on the evolving landscape of gold pricing in the city.

Gold Rates Today in Hyderabad

As of today, gold rates in Hyderabad reflect a dynamic market influenced by various factors, including local demand, global trends, and economic conditions. Currently, the price of 22-carat gold in Hyderabad stands at approximately INR 5,600 per gram, while 24-carat gold is priced around INR 6,100 per gram. These rates may vary slightly based on the retailer and time of purchase, so it is advisable for consumers to verify prices before making any transactions.

Hyderabad, being a hub for gold jewelry, shows a unique pattern of demand influenced by cultural traditions and festivals. Gold plays a significant role in various ceremonies, particularly weddings, leading to increased purchases during auspicious seasons. This surge in demand often impacts the gold rates in the city, making it essential for potential buyers to monitor market trends closely.

Moreover, the gold market in Hyderabad is subject to influences from international pricing, exchange rates, and local economic conditions. Fluctuations in these areas can contribute to daily changes in gold rates. Market analysts suggest that any rise in global gold prices tends to be mirrored in local rates, further emphasized by the city’s cultural affinity towards gold jewelry.

In addition to the factors listed above, the city’s historical relationship with gold mining and trading also plays a role in shaping its market. In Hyderabad, consumers value purity and quality, often favoring certified jewelers, which can contribute to higher retail prices as compared to unbranded options.

With a keen understanding of market influences and local cultural dynamics, individuals in Hyderabad can make informed decisions about gold purchases. Regularly checking current gold rates ensures that consumers are equipped with the necessary information to navigate their investments judiciously.

Comparison of Gold Rates: Chennai vs. Hyderabad

Gold has long been a highly sought-after commodity in India, serving as both an investment and a social symbol. In the two major southern cities of India, Chennai and Hyderabad, gold rates exhibit distinct trends influenced by regional demand and market conditions. As of October 2023, both cities see fluctuating gold prices, reflecting a broader national trend in gold’s valuation.

Chennai often witnesses higher gold rates compared to Hyderabad, primarily due to its cultural significance where gold is an integral part of regional festivals and weddings. The demand for gold jewelry in Chennai tends to be robust, driven by traditional customs and an affluent buyer base. Additionally, local artisans and jewelers maintain a high level of craftsmanship, which can further elevate gold prices by impacting the overall jewelry cost.

In contrast, Hyderabad’s gold market operates within a slightly different framework. Here, the demand is also significant; however, the city has seen a diversification in its consumer preferences. Many young buyers are increasingly leaning toward gold investments in the form of bars and coins rather than traditional jewelry. This shift could be a response to the evolving economic environment and investment strategies. Additionally, the presence of several regions engaged in gold trading can lead to slightly lower gold prices in Hyderabad, reflecting more competitive market conditions.

Another aspect worth considering is the impact of local policies and taxes. In Chennai, the state’s regulations have sometimes resulted in higher taxes on gold purchases, influencing the final retail price. Hyderabad benefits from comparatively lower rates, further amplifying its appeal to consumers. Over time, these regional differences might lead to varying trends in the gold market, making it essential for buyers to stay informed about current rates and market dynamics in both cities.

Gold Rates in Bangalore and Delhi

As of the most recent data, gold prices in Bangalore and Delhi exhibit a notable variance influenced by local economies and cultural preferences. In Bangalore, the current rate for 22-karat gold stands at approximately ₹5,750 per gram. This reflects a strong demand driven by the city’s bustling IT industry and the resulting affluence. On the other hand, Delhi’s gold prices for the same karat are slightly lower, hovering around ₹5,700 per gram. The slight disparity in pricing can be attributed to competition among jewelers and the broader market conditions.

When comparing these cities to Chennai and Hyderabad, one can observe marked differences in pricing trends. For example, in Chennai, 22-karat gold is priced at around ₹5,720 per gram, benefiting from a rich tradition of gold jewelry, which often influences consumer demand. In contrast, Hyderabad’s gold prices are comparable, generally around ₹5,690 per gram, highlighting the regional variations and local market dynamics.

Cultural factors also play a significant role in determining gold prices. In Bangalore, the tech-driven economy has led to increased purchasing power, fostering a culture where gold is increasingly seen as an investment. Conversely, in Delhi, gold jewelry remains a staple in weddings and festivals, sustaining a steady demand throughout the year. Thus, local economies and cultural preferences not only shape the gold rates but also set the tone for consumer behavior in these cities.

In conclusion, understanding the variations in gold prices across Bangalore, Delhi, and other major cities such as Chennai and Hyderabad is essential for investors and consumers alike. The interplay of local economies and cultural practices continues to affect gold demand and pricing in these metropolitan centers.

Historical Perspective: Gold Prices Over the Last Year

The past year has presented a dynamic landscape for gold prices in India, reflecting a combination of local demands, international trends, and broader economic indicators. At the beginning of the year 2023, gold prices experienced a noticeable increase, primarily driven by geopolitical uncertainties and inflationary pressures that prompted investors to seek safe-haven assets. This behavior aligns with historical trends, wherein gold has traditionally served as a hedge against economic instability.

During the first quarter of 2023, the price of gold reached an all-time high, climbing steadily as global tensions, including ongoing conflicts and trade disputes, swayed market confidence. Investors capitalized on these conditions, resulting in a surge in both retail and institutional purchasing of gold in various forms, including jewelry, coins, and bars. Such heightened demand directly influenced gold prices, which fluctuated significantly in response to prevailing sentiments in both domestic and international markets.

In the final quarter of 2023, the price of gold experienced stabilization, as both regional and global economic considerations began to balance out. Overall, looking back over the past year, it is evident that gold prices in India have been significantly impacted by a blend of domestic demand, international market trends, and global economic conditions. This multifaceted influence underscores the complex relationship between gold prices and broader economic indicators.

Factors Affecting Today’s Gold Prices

The calculation of gold prices today is influenced by a multitude of factors that contribute to its perceived value in the global market. Among them, interest rates play a significant role. Typically, when central banks, such as the Reserve Bank of India, increase interest rates, the opportunity cost of holding non-yielding assets like gold rises. As a result, investors may favor interest-bearing investments, leading to a potential decline in gold prices. Conversely, lower interest rates can enhance gold’s attractiveness, encouraging investment and driving up prices.

Inflation is another critical factor affecting gold prices. Historically, gold has been considered a hedge against inflation, as it tends to maintain its value over time. When inflation rates surge, the purchasing power of currency diminishes, prompting investors to flock to gold as a means to preserve their wealth. Thus, rising inflation often correlates with increasing gold prices, whereas deflationary trends might suppress demand for gold and lead to lower prices.

Global market trends are also influential in determining current gold prices. The interplay between supply and demand dynamics across various markets affects how gold is priced internationally. For instance, significant upswings in demand from countries like China and India, particularly during festive seasons, can result in price hikes. Additionally, fluctuations in the value of the US dollar have a reciprocal relationship with gold prices; a stronger dollar generally weakens gold demand, while a weaker dollar boosts its allure for international buyers.

Lastly, geopolitical events can precipitate dramatic shifts in gold prices. Situations such as political unrest, military conflicts, or economic sanctions can create uncertainty in the markets. In response, investors often turn to gold as a safe haven asset, driving its prices higher. Accordingly, the sensitivity of gold prices to these myriad factors underscores the complexity of the gold market and the importance of staying informed about economic and geopolitical developments.

Tips for Buying Gold Today

When considering purchasing gold, it is crucial to stay informed about current market conditions. Gold prices fluctuate based on various factors including global economy, currency strength, and market trends. Monitoring these elements will provide insights into the most advantageous timing for your purchase. For instance, buying during a dip in prices can maximize your investment potential.

If you are looking to buy gold jewelry, it is essential to select a reliable and reputable jeweler. This ensures the authenticity of the gold while providing options of good craftsmanship. Consider visiting multiple stores to compare designs, purity levels, and prices. Be aware that the no matter the design, the price of gold jewelry often includes additional crafting costs, which can impact your overall expenditure.

On the other hand, if your focus is on gold as an investment, explore avenues like gold coins, bars, or exchange-traded funds (ETFs). Each option comes with its own benefits and drawbacks. Gold bars and coins typically offer the highest purity levels, which is a critical factor for investors. They also allow for easier resale in case you decide to liquidate your investment. ETFs provide an accessible means of investing in gold without the need to hold physical gold, allowing for portfolio diversification.

Additionally, it is advisable to stay updated on regulatory changes that may impact gold purchases in India. Being aware of policies concerning gold taxation, import duties, and hallmarking will help you navigate your purchase more effectively. To sum up, understanding the market trends, selecting the right purchase type, and ensuring authenticity will empower you to make informed decisions on buying gold today.