Introduction to Earnings Reports

Earnings reports are essential financial documents that publicly traded companies release on a quarterly basis. These reports offer a comprehensive snapshot of a company’s financial health and performance over a specified period. They encompass various metrics, including revenue, net income, Earnings Per Share (EPS), and cash flow, which are pivotal for investors and analysts.

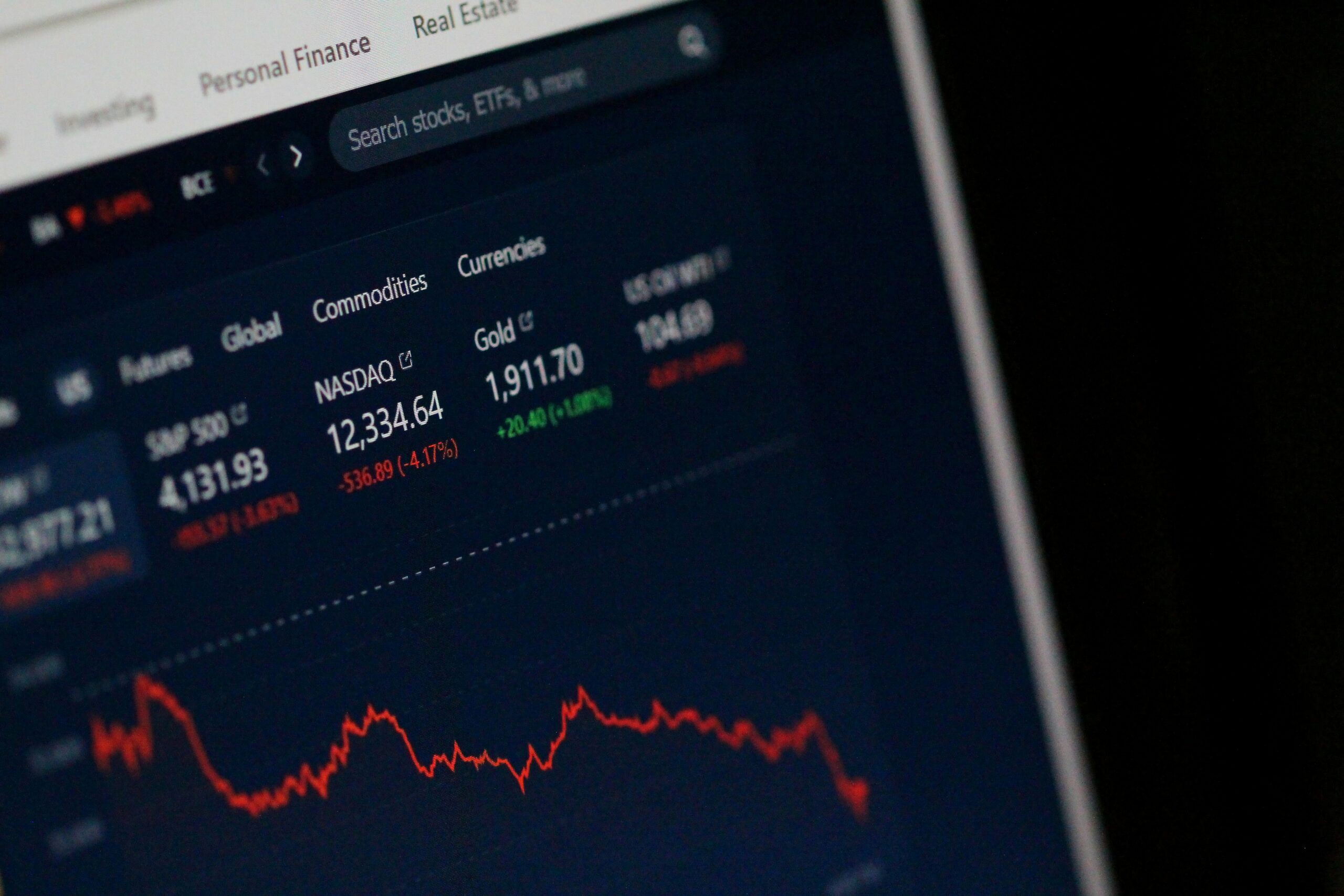

The significance of earnings reports in the stock market cannot be overstated. These reports serve as a benchmark for evaluating a company’s profitability and operational efficiency. When a company meets or exceeds its projected earnings, it often leads to a boost in investor confidence, positively impacting its stock price. Conversely, falling short of expectations can result in a decline in market value and erode investor trust.

One of the most critical components of earnings reports is the Earnings Per Share (EPS). EPS is calculated by dividing the company’s net profit by the number of outstanding shares. It provides a convenient way for investors to gauge the company’s profitability on a per-share basis, making it easier to compare performance across different firms in the same industry. Revenue, on the other hand, represents the total income generated from sales before any expenses are deducted. It’s an indicator of the company’s ability to generate sales and grow its market share.

Earnings reports also offer insights into several key financial indicators, such as Gross Profit Margin, Operating Income, and Net Income. These metrics help investors understand the company’s cost structure, operational efficiency, and overall profitability. Additionally, earnings reports often include forward-looking statements, providing guidance on future performance and market conditions.

In summary, earnings reports play a crucial role in the decision-making process for investors, analysts, and stakeholders. They provide a transparent view of a company’s financial condition and performance, influencing stock prices and shaping market perceptions. Understanding these reports is vital for anyone involved in the stock market, as they serve as a foundation for informed investment strategies.

Meta (Facebook) Earnings

The recent earnings report from Meta, formerly known as Facebook, was released on July 28, 2023. This report was highly anticipated by investors and analysts alike, reflecting on the company’s financial health and strategic direction. Meta reported revenues of $33.67 billion for Q2 2023, demonstrating a year-over-year increase of 11%. This growth was driven primarily by robust ad sales and an increased focus on short-form video content through its platform, Reels.

Key performance indicators (KPIs) highlighted in this earnings report include daily active users (DAUs) and monthly active users (MAUs), which stood at 2.13 billion and 3.39 billion, respectively. Both metrics showed modest growth, underscoring Meta’s continued dominance in the social media space. Additionally, average revenue per user (ARPU) increased to $10.12, signaling effective monetization strategies across Meta’s suite of apps, including Facebook, Instagram, Messenger, and WhatsApp.

Another noteworthy announcement from Meta’s earnings report was their advancements in the metaverse. The company disclosed significant investments in virtual reality (VR) and augmented reality (AR), focusing on their long-term vision for the metaverse. Mark Zuckerberg, Meta’s CEO, emphasized that while these investments are currently weighing on the bottom line, they are expected to yield substantial gains in the future.

The stock market’s reaction to Meta’s earnings report was mixed initially. The shares saw a minor dip due to concerns over increased spending and the competitive landscape in digital advertising. However, the long-term outlook remains optimistic. Many analysts predict that Meta’s strategic initiatives, such as Reels and metaverse investments, will potentially drive significant revenue growth and user engagement.

Looking ahead, Meta’s financial trajectory appears promising, bolstered by its persistent innovation and expansive user base. Investors will be closely monitoring how these strategic investments pan out and their impact on the company’s profitability and market position in the coming quarters.

Microsoft Earnings and Predictions

Microsoft, a formidable player in the tech sector, recently revealed its earnings report for the latest fiscal quarter, providing insights into its diverse revenue streams. The earnings report, published on [specific earnings date], underscored the company’s stellar performance across various segments. Key highlights included substantial gains in cloud computing, significant contributions from enterprise software, and a robust consumer products division.

The cloud computing segment, particularly Azure, continued its impressive growth trajectory, registering a year-over-year increase of [specific percentage]. This surge underscores the rising demand for cloud services as businesses increasingly shift to digital transformation strategies. Similarly, Microsoft’s enterprise software division benefited from strong uptake in its Office 365 subscriptions and Dynamics 365 offerings, contributing a significant portion to the overall revenue.

On the consumer side, products such as Windows, Surface devices, and Xbox also showed robust performance. The recent quarter saw Windows OEM revenues increase by [specific percentage], driven by a steady demand for personal computers. Surface products reported consistent sales, reflecting the market’s positive reception towards Microsoft’s hardware innovations. Furthermore, Xbox content and services saw a boost owing to the launch of new titles and the expanding subscriber base for Xbox Game Pass.

The earnings call featured key forward-looking statements from Microsoft’s executive team, projecting continued growth. CEO Satya Nadella emphasized the company’s commitment to advancing its cloud infrastructure and expanding AI capabilities. CFO Amy Hood highlighted strategic investments aimed at sustaining growth in enterprise solutions and consumer products.

These statements reflect a positive outlook, with Microsoft anticipating sustained momentum across its primary revenue streams. Investors and stakeholders remain optimistic, given the company’s continuous emphasis on innovation and market expansion, suggesting a promising future for Microsoft’s financial performance.

Nvidia Earnings Insights

Nvidia recently unveiled its financial performance for the latest quarter, reaffirming its position as a significant player in the tech industry. Reporting on [specific date], the company disclosed a notable revenue increase driven by robust performances across its gaming and data center segments. For the quarter, Nvidia’s revenue reached an impressive $x.x billion, reflecting a year-over-year increase of xx%.

The gaming segment, a core component of Nvidia’s business model, generated notable revenue amounting to $x.x billion. This strong performance is attributed to the high demand for Nvidia’s GeForce RTX graphics cards, which continue to be popular among gamers and professionals seeking high-performance solutions. Furthermore, Nvidia’s data center business also reported a substantial increase, with revenues of $x.x billion. This growth is largely driven by the escalating adoption of artificial intelligence (AI) technologies and machine learning applications, where Nvidia’s leading GPU technology plays a crucial role.

Beyond these primary areas, other segments, including professional visualization and automotive, also demonstrated growth. Nvidia’s professional visualization segment earned revenues of $x.x billion, benefitting from expansion in remote work and virtual collaboration tools. Meanwhile, the automotive sector, although smaller, saw an uptick due to advancements in autonomous vehicle technology and strategic partnerships with leading car manufacturers.

The market reacted positively to these earnings, with Nvidia’s stock price experiencing a notable rise following the report. Investors are particularly optimistic about Nvidia’s future product launches and technological advancements. The upcoming releases of next-generation GPUs and developments in AI hardware are highly anticipated. Additionally, collaborations and strategic investments in burgeoning fields like the metaverse and edge computing are expected to further bolster Nvidia’s market position.

Moving forward, Nvidia remains focused on innovation and expanding its market presence. With a strong financial foundation and a clear vision for technological advancement, the company is well-positioned to sustain its growth trajectory in the rapidly evolving tech landscape.

AMD Earnings Performance

In the current fiscal quarter, Advanced Micro Devices (AMD) reported substantial growth, showcasing robust earnings across revenue channels. AMD’s total revenue for the period reached $5.89 billion, marking a notable year-over-year increase propelled by enhanced performance in both the CPU and GPU markets. A significant factor in AMD’s financial achievements is their successful navigation through the highly competitive semiconductor industry, notably contending with major rivals such as Intel and Nvidia.

One of the pivotal highlights of AMD’s performance is their increasing market share in the CPU arena. The company has continued to innovate with its Ryzen and EPYC processors, securing substantial traction in both consumer and enterprise sectors. This rise can be attributed to the enhanced performance capabilities and competitive pricing strategies of their new processor lineups, making them a preferred choice over Intel’s offerings in various segments. Concurrently, AMD’s advancements in the GPU market, particularly with their Radeon graphics cards, have seen continued adoption, challenging Nvidia’s dominance despite the latter’s entrenched position.

During the latest earnings call, AMD’s executives expressed optimism about sustained growth, emphasizing investments in research and development as well as strategic partnerships. The ongoing focus on innovation is expected to keep AMD at the forefront of technology, especially in burgeoning fields such as AI, machine learning, and high-performance computing. Additionally, the company provided future guidance that suggested continued strong demand across both core and emerging markets, promising positive outlooks for subsequent quarters.

While competition with Intel and Nvidia remains fierce, AMD’s ability to deliver cutting-edge technology and flexible solutions has enabled it to carve out a significant niche. Market analysts have noted the importance of AMD’s agility in responding to market trends and consumer needs, reinforcing their competitive stance in an ever-evolving tech landscape. Investors and stakeholders are closely monitoring AMD’s performance metrics, looking for indicators that the company will maintain its upward trajectory amidst the competitive pressures from other tech giants.

Earnings Calendar and Key Dates

Understanding the earnings calendar and key dates for tech giants such as Apple, Amazon, and Starbucks is crucial for investors seeking to make informed decisions. Earnings reports provide vital insights into a company’s financial health, performance, and growth potential. These reports typically include data on revenue, net income, earnings per share (EPS), and other essential financial metrics. By closely monitoring these reports, investors can gauge whether the company is meeting, exceeding, or falling short of market expectations, which in turn influences stock prices and overall investment strategies.

For instance, Apple usually releases its quarterly earnings reports in the last week of January, April, July, and October. Key dates to watch for Amazon are late January, April, July, and October as well. Starbucks tends to report its earnings in early February, early May, early August, and early November. Keeping track of these dates allows investors to anticipate market movements, as stock prices often react to earnings surprises, whether positive or negative.

The importance of tracking earnings dates cannot be overstated. Earnings season, which typically occurs four times a year, can be a time of increased volatility in the stock market. Positive earnings results can drive stock prices higher, enhancing investor sentiment and attracting more investment. Conversely, disappointing earnings results can lead to a decline in stock prices, prompting investors to reassess their positions and potentially sell off their holdings.

Moreover, earnings reports often provide forward-looking statements and guidance, which offer valuable insights into a company’s future prospects. This information is critical for modeling financial forecasts and adjusting investment portfolios accordingly. In addition, earnings calls, held on the same date as the earnings release, detail more qualitative aspects of performance and allow investors to hear directly from company leadership about strategic initiatives, challenges, and market opportunities.

Investor Relations and Communication

Investor relations (IR) departments play a crucial role in major tech companies by acting as the bridge between the corporation and its shareholders. The primary function of these departments is to facilitate transparent and effective communication, ensuring that investors are well-informed about the company’s financial performance and strategic direction. This, in turn, fosters trust and aids in maintaining investor confidence.

One of the key responsibilities of IR teams is to manage earnings calls, which are periodic teleconferences during which senior management discusses quarterly financial results with analysts and investors. These calls provide a platform for company leaders to present their financial achievements, operational highlights, and future outlook. By doing so, they guide shareholder expectations and offer insights into the company’s strategic initiatives.

Beyond earnings calls, IR departments also prepare and disseminate earnings reports. These documents provide detailed information about the company’s revenue, expenses, profit margins, and other crucial financial metrics. Earnings reports are meticulously crafted to offer a comprehensive picture of the company’s performance and to comply with regulatory requirements. By analyzing these reports, investors can make informed decisions regarding their investments.

Furthermore, investor relations teams handle direct communication with shareholders through various channels, including press releases, investor meetings, and digital platforms. They address queries and concerns, provide clarifications on financial data, and offer updates on corporate actions and developments. Effective communication by IR departments helps to mitigate misinformation and manage market perceptions.

Investor relations departments are also instrumental in financial analysis and strategic planning. They closely monitor market trends, competitor performance, and economic indicators to provide actionable insights to top management. These insights enable companies to align their strategies with market dynamics and investor expectations.

In essence, the investor relations function is vital for ensuring transparency, fostering investor engagement, and supporting a positive image of the company in the financial markets. By maintaining open lines of communication and delivering insightful analyses, IR departments contribute significantly to a tech company’s overall success and stability.

Impact of Earnings Reports on Stock Performance

Earnings reports serve as critical indicators of a company’s financial health and future prospects, significantly influencing stock performance. For tech giants like Meta, Microsoft, Nvidia, and AMD, these reports are often pivotal moments that drive stock prices either upwards or downwards. Typically, stock performance is tied closely to the information disclosed in the earnings reports, which include revenue figures, net income, and forward-looking statements about the company’s future.

Historically, earnings reports have induced substantial volatility in the stock prices of these companies. For instance, Meta’s stock experienced a considerable surge in July 2021 when it reported a 56% increase in revenue, exceeding market expectations. Conversely, Nvidia faced a stock plunge in November 2018 when its earnings report revealed a decline in data center sales, which alarmed investors and led to a swift sell-off.

Experts often predict stock movements based on pre-earnings announcements and market sentiment. For instance, analysts closely monitor trends in key metrics and industry conditions leading up to the earnings release. An optimistic outlook and strong performance metrics can trigger a buying spree, while any signs of underperformance may result in a sell-off. Most recently, Microsoft’s Q2 2022 earnings beat Wall Street’s predictions, leading to an immediate 5% appreciation in its stock price.

For investors, making informed decisions based on earnings reports requires a comprehensive strategy. One effective approach is to look beyond the headline numbers and delve into the underlying business drivers such as user growth, product innovation, and market expansion efforts. Additionally, understanding the broader economic context and industry trends can provide valuable insights. Investors should also consider diversifying their portfolio to mitigate risks associated with the volatility that often accompanies earnings reports.

In summary, earnings reports are instrumental in shaping the stock trajectory of tech giants. By carefully analyzing these reports and aligning investment strategies with expert predictions and historical data, investors can navigate the complexities of the stock market more effectively.